Inflation continues to increase, and savers continue to face a battle if they want to beat its corrosive effects. Inflation is a cause of concern for Irish people. The last 2 and half years have provided the vital ingredients for an inflation cocktail. The increase in money supply, bottleneck supply lines, increase in energy prices, and increase in demand have all contributed to inflation.

Inflation was going to happen post-pandemic and the Ukraine-Russia crisis has only exacerbated the impact of inflation in Europe. Although the impact of the Russian-Ukrainian war is being felt with higher oil and gas prices worldwide, I think the bigger threat is the impact on the global food supply. Ukraine and Russia are two of the breadbaskets of the world. They play a vital role with the export of primary staples like wheat to many of the middle eastern and African countries. The inability of poorer countries to pay the higher cost of food will cause malnutrition and starvation.

In Ireland, inflation hit nearly 7% in March. Many countries in Europe are experiencing inflation as high as 10%. I don’t think it’s going to decrease for some time; I think it will continue to rise higher in the short term.

I was talking to a coffee truck owner recently, and he was explaining to me that the price of coffee beans has increased by 30%, and he will have to hike up his prices in June. The impact of inflation has a domino effect on businesses across Ireland. Businesses will have to increase their prices or decrease their costs to earn the same profit. The impact on lower-income households will also be significant. They will have less disposable income to pay for higher food costs and higher energy bills.

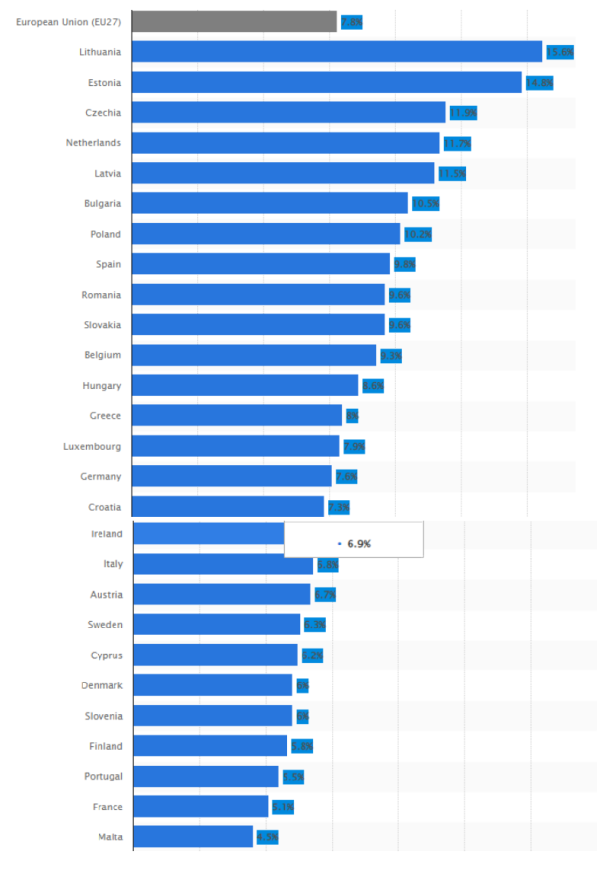

As of March 2022, the inflation rate in the European Union was 7.8% with prices rising fastest in Lithuania, which had an inflation rate of 15.6%. On the other side, inflation in Malta was 4.5%, which was the lowest in the EU in March. Before the rise in 2021, inflation in the EU was at relatively low levels, having never reached higher than 3% between January 2012 and August 2021.

Inflation in Europe

WHY INVESTING DURING INFLATIONARY PERIODS IS IMPORTANT

Investing in a diversified fund over a long period is one of the best ways to build wealth. You will grow your money over long periods of time (hopefully), and you will counter the inflation threat. With inflation here now, savers who don’t invest will be punished, and their purchasing power will decrease over time. However, with investing you face another issue – one of dealing with the worry and the volatility of your investment over time. The price of investing in the stock market, which represents the best companies in the world, is the risk, volatility, and worry. The reward is generating good returns over a long period of time.

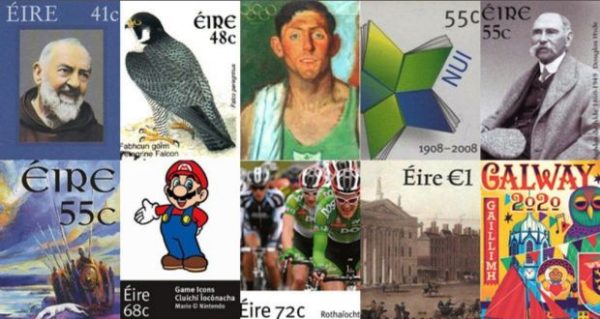

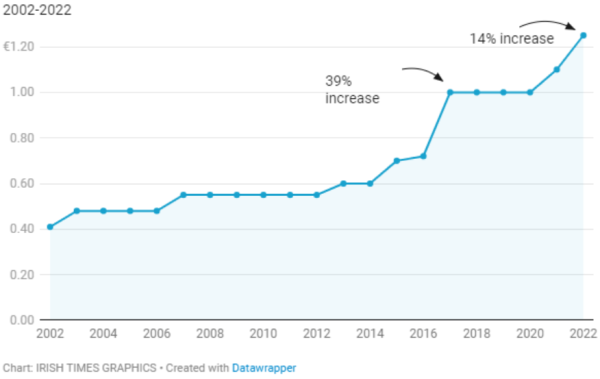

If we look at an Irish postage stamp, we will be able to see the impact of inflation over time. Everyone posts letters, and there has been a gradual increase in the price of a stamp over time.

Rising Prices of Irish Stamps

The price of a stamp in 2002 was €0.40. Now the price of a stamp is €1.25. The price has tripled. If you had a €100 in 2002, you would have been able to buy 250 stamps, whereas today you will only be able to purchase 80. Your purchasing power over 20 years has eroded significantly.

Irish Postage Stamp Increase Over Time

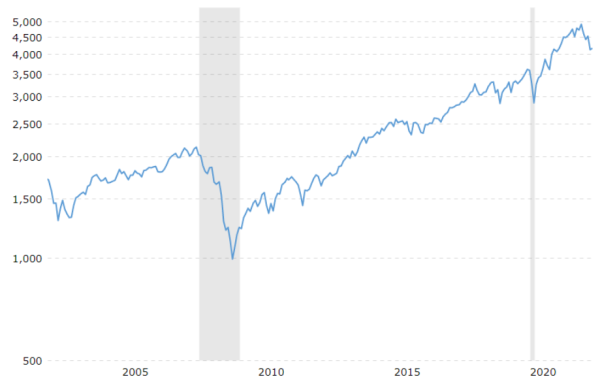

S&P 500 CHART OVER 20 YEARS

It’s important to show the significance of investing over time to try to counterbalance the impact of inflation. As an example, let’s imagine you had invested €100 in the S&P 500 (which represents the top 500 companies in the USA). In May 2002, the S&P 500 was valued at 1,706. It is now worth 4,175.

The S&P 500 is now valued at 2.447 times more than it was in 2002. If you had invested €100 in 2002, it would now be worth €244.70. This would allow you to purchase 195 stamps today, which is a lot more than if you had left that €100 earning no return over time, only providing you with a capacity to purchase 80 stamps today.

In summary, investing is not only about generating wealth but maintaining your purchasing power during inflationary times.

S&P Chart Over 20 Years

“The best protection against inflation is still your own personal earnings power. The best solution is to be the best you can at something, as people will pay for an excellent doctor, singer, or baseball player.”

Warren Buffet

Warren Buffet

MY VIEW ON INVESTING

I think the key principle when it comes to investing is to make sure you’re invested in the best companies across the world through diversification. A long-term investment portfolio will build wealth by capturing “many or most of the major themes of modern global capitalism”. Don’t lose too much sleep when the values go down, as they inevitably will. Accept volatility as the efficient relationship between larger temporary declines and larger permanent advances. Battling your own emotions is the most important factor in investing and trying to remain calm is key. Do remember this: the stock market has had a consistent upward trajectory for over 100 years, and it will continue to do so for the next 100 years.

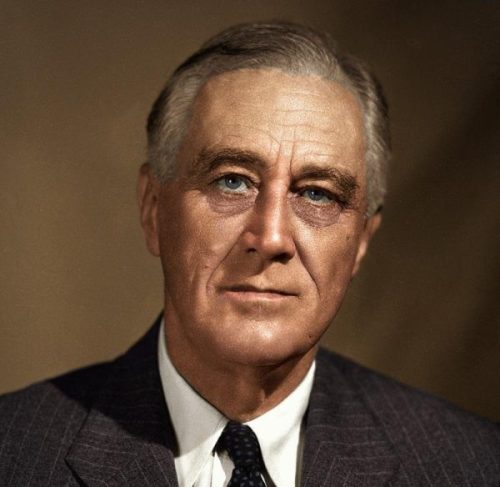

“So first of all let me assert my firm belief that the only thing we have to fear is fear itself – nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance. ”

Franklin D Roosevelt – First Inaugural Address March 4, 1933

Franklin D Roosevelt

Eoin Wilson

Financial Adviser

CFP® MSc Finance BA Econ Q.F.A

Please note this is not legal, tax or financial advice.

If you have any queries, please get in touch at eoin@purefinance.ie.