In this blog post, I’m going to talk about Inversion and how it applies to your finances.

If you haven’t read James Clear’s book, “Atomic Habits”, I would highly recommend it. In his book, he writes about the ancient Stoic philosopher Marcus Aurelius. This Stoic philosopher conducted an exercise known as “premeditatio malorum”, which translates to “premeditation of evils”. The main goal of this exercise is to envisage the negative things that could happen in life.

The Stoics would imagine what it would be like to lose their job, become homeless, suffer an injury, become paralysed or have their reputation ruined.

The Stoics thought that by imagining the worst-case situation ahead of time, they could overcome fears of negative experiences and make better plans to prevent them.

This is a very powerful tool, and it can be applied to Financial Planning.

So how can this apply to your finances?

Equestrian Statue of Marcus Aurelius

PROTECTING YOUR FAMILY IN THE EVENT OF DEATH

What is the worst thing that could happen to a working Individual? If I take it from a financial planning perspective and look inward, it’s probably death.

If I look at my own situation – I’m a married man with 2 young daughters – the worst thing that could happen to me is that I could die in my 40s, 50s or 60s. I’m more likely to die in my 80s, but there is still a chance that it could happen. Statistically, it’s 1%.

I don’t like to think about mortality. However, to protect my wife and two daughters financially, I crossed the bridge and took out Life Cover, and I review it on an ongoing basis.

The average cost to insure a man or woman in their 30’s is €10 for every €100,000.

If you’d like to review your Life Cover needs, please click here to email me.

PROTECTING YOUR INCOME IN THE EVENT OF SICKNESS

The second area that is incredibly important is protecting your income or having reserves in place if you can’t work due to sickness or ill-health.

Again, looking at myself as an example – I’m self-employed, so if I can’t work due to a serious illness such as cancer or any other debilitating health condition, the government will not provide me with disability benefits. I have taken out Insurance to protect myself in the event of being unable to work, due to sickness. This will protect my business and my income.

If you’d like to review your Income Protections needs, please click here to email me.

EMERGENCY SAVINGS

Another really important area is having enough savings if emergencies arise. I would generally recommend having 6 months of living expenses saved with the bank. If you’re unable to work due to a minor illness, have car repairs, unexpected house repairs, or want to move jobs, adequate reserves in place will withstand any unexpected short-term financial pressures.

INVESTING

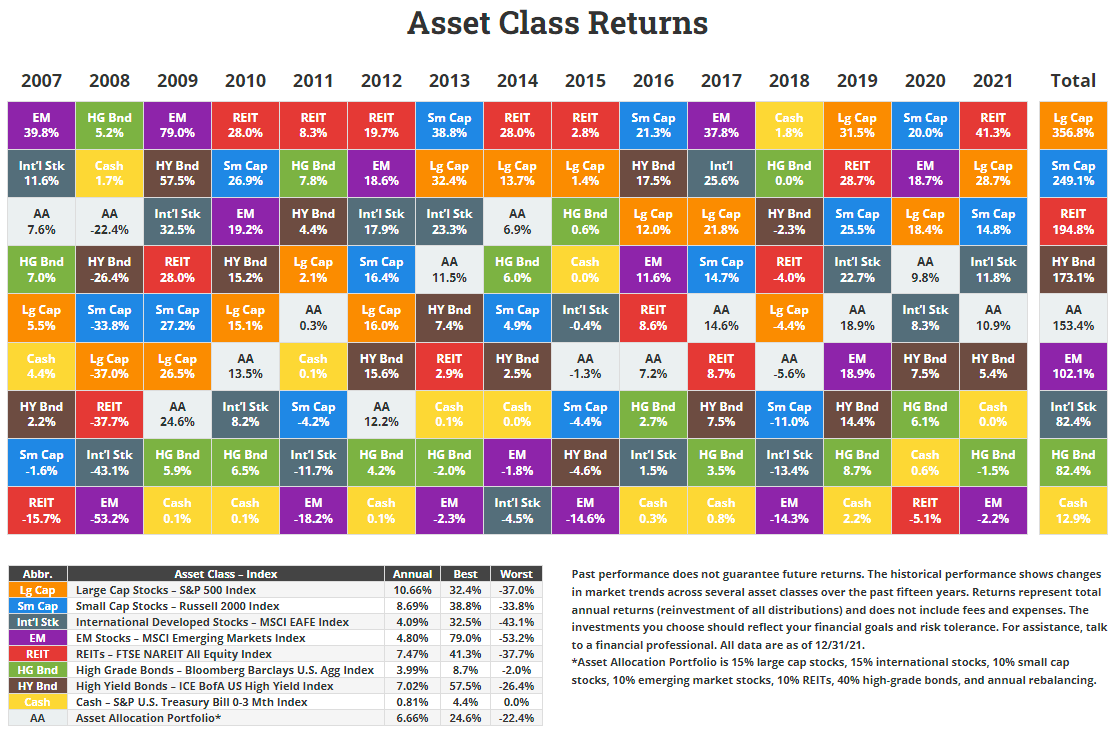

If we consider investing from an inverted perspective, the worst-case scenario is that you lose all your money when investing. There is a chance this could happen with any investment. It’s very unlikely if you’re well-diversified, but more likely if you’re invested in one stock or one asset class.

Many of the unregulated investments are very high risk. Some examples would include Loan Notes, Crowdfunding, and Cryptocurrency. You can make high returns with all of these. Equally, you can lose a lot quickly.

Also, be mindful if you have wealth tied up in one company. This often happens when employees of big tech companies buy company stock at a discount. The issue here is you have all your wealth tied up in one company and one industry. The Nasdaq represents some of the world’s largest tech companies and it has fallen by over 14% recently.

In my view, the best way to minimise unnecessary risk is to not have all your eggs in one basket. Don’t just hold Amazon stock or Bitcoin. Make sure you’ve invested in a well-diversified fund that invests in the world and in different asset classes.

Asset Class Returns

INVESTMENT REFLECTION

January was a very volatile month for the stock market with investments swinging up and down daily. A big reason for the stock market volatility is that the US Federal Reserve has indicated that it will probably increase interest rates in the US in March. They are raising interest rates to dampen inflation.

Raising interest rates can have a negative impact on the economy as the cost of borrowing for businesses and consumers will increase. In Europe, it is unlikely that we will see a hike in interest rates. In Ireland, we are also dealing with the impact of inflation, which is driving up the cost of living. Investing over a long period of time can counterbalance the impact of inflation.

As a client of Pure Finance, I’m here to guide you in good times and bad times when it comes to your Investment Journey. Remember – this period of volatility too shall pass. If you have any questions regarding your Pension or Investment, please get in touch.

To calmer markets and a better 2022.

Eoin Wilson

Financial Adviser

CFP® MSc Finance BA Econ Q.F.A

Please note this is not legal, tax or financial advice.