As Halloween approaches, the days get darker, it gets colder. Houses start decorating for the big day on the 31st of October. Leaves start falling, it’s a spooky time. Pensions also coincide with Halloween. Pensions often make people uncomfortable, they are complex, and for most people, they are so far in the future. They are also intangible.

However, this Halloween, perhaps consider giving your future 65-year-old self, a future treat. There are significant advantages to paying a lump sum before the tax deadline. I’m told a good pension can also ward off evil spirits in your 60s.

Pensions provide incredible tax reliefs (Tax relief on Income, Tax relief on Investment growth, tax-free lump sum, tax-free growth after you retire)

Tax Relief – A Pension is still one of the best ways to accumulate wealth over the longer term. If a higher income earner pays €600 into a Pension, the government will pay €400.

Tax-Free Growth – There are very few investments that can grow tax-free, and this is one of the biggest advantages of a Pension. If you invest over the longer term, your Pension may double, triple, or quadruple in value. That’s a really worthwhile benefit – as the value of your plan should build up much more quickly than in a fund that has to pay tax.

Tax-Free Lump Sum – with a Pension you can receive a lump sum of 25% of the fund value tax-free, with a limit of €200,000 Tax-free. It certainly makes sense to target a Pension of €800,000. For a lump sum larger than this they are taxed at 20%.

Tax-Free Growth Post Retirement – One of the most significant advantages of a Pension is once you reach retirement age, you can continue to benefit from tax-free investment growth. If you invest in an Approved retirement fund, the earnings accumulate tax-free.

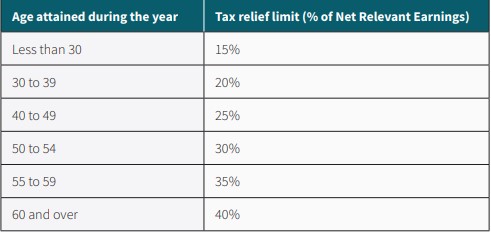

MAXIMUM RELIEF ALLOWABLE FOR PERSONAL CONTRIBUTION

*Maximum allowable salary €115,000

EXAMPLE

Chris is earning €80,000 and is 50 years old. His employer is already paying 5% (€333 per month) and he is also paying €333.33 per month.

If he pays €10,000 this year before the tax deadline, he will have €10,000 invested in a Pension, and revenue will refund him €4,000.

PENSION TAX DEADLINES

Income Tax Deadline

Paper filing 31st of October

Online filing 15th November

REVENUE ONLINE DOCUMENT

A Revenue Declaration will need to be completed in advance of the tax deadline. Email emma@purefinance.ie for the form. If you need any pension advice give me a call on 086 7954972 or email me at eoin@purefinance.ie.

PODCAST

I did a podcast earlier this year on Dublin City FM, talking about how I started in Financial Services. Click here to listen

Enjoy and Happy Halloween