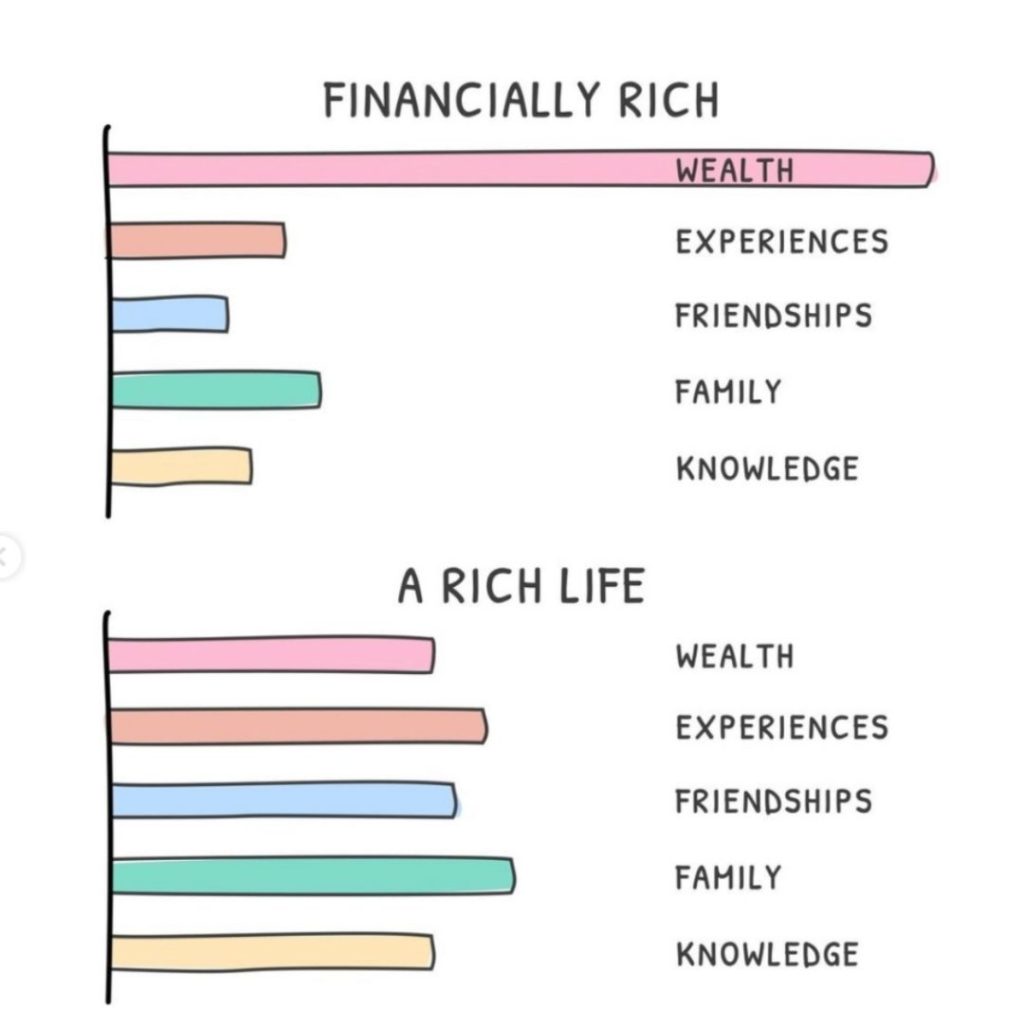

As a Financial Planner, I try to build wealth for customers through investing, retirement planning, and financial planning. But what exactly is wealth? Wealth in the traditional sense is monetary wealth. The technical definition is “the abundance of valuable possessions or money”. However, the old English origin of the word is “well-being” or “welfare”.

I recently saw a LinkedIn post by Steven Bartlett, who brought home what real wealth is.

It’s having a rich life, which includes having monetary wealth but also having great experiences, a great family life, being healthy, and having knowledge. Obviously, this can differ from person to person, but I do think, as a society, we all should try to identify what is real wealth for us.

What is real wealth for you?

Source: Steven Bartlett

For me, real wealth has the following ingredients: family, money, time, friends, and hobbies.

Money and time are probably the two most important ingredients. Trying to balance the two is one of life’s greatest challenges. However, health and family are ultimately the most important.

This brings me to protecting what matters. Most people have house insurance and car insurance. Some people even have phone insurance. However, it’s important to protect what matters: your health and your family.

HEALTH INSURANCE

Your health is a crucial part of your overall well-being. Health insurance is one of the most important insurances you can buy. You may not need this for years, but having more choice to select your preferred hospital, and most importantly, getting seen quickly, are important.

I don’t provide advice on health insurance. However, I would always suggest to customers that they take it out sooner rather than later, as the price is more competitive. Importantly, when you’re healthy you’re insurable. If you’re switching, be careful and make sure the new insurer has the same coverage. Lastly, make sure your premiums are always up to date. Your policy could lapse and cancel if a premium isn’t paid.

A useful website I came across to compare health insurance plans: Compare Health Insurance in Ireland | HIA

INCOME PROTECTION

I really do believe in this type of insurance. Income protection gives you a financial cushion in the form of a replacement income of up to 75% of your previous earnings should an accident or illness prevent you from working in the future and earning a living income.

It’s important to remember that the state will only provide €208 per month for a single person if you can’t work due to sickness or ill health.

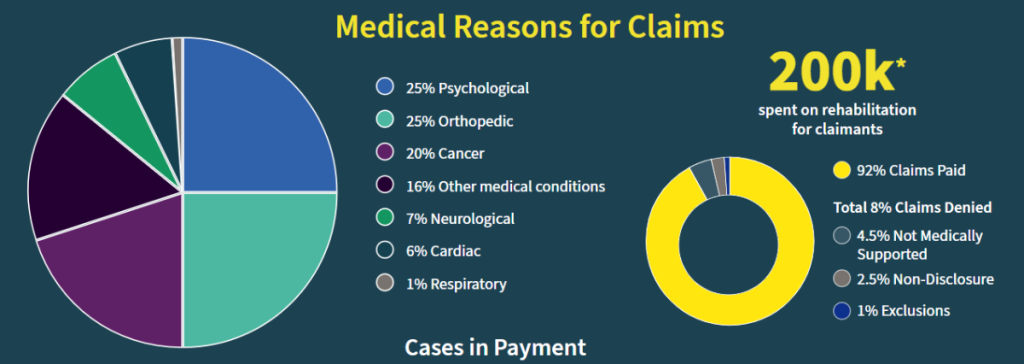

Aviva is one of the leading providers of Income Protection in Ireland. The average age of a payout with them was 48 years old. A common misconception is that insurance companies don’t pay out. However, Aviva paid out 92% of its Income Protection claims in 2021, paying out to 2,000 people last year, with a total of €46 million.

Aviva claims paid out in 2021

SERIOUS ILLNESS COVER

This is another important type of insurance that insures you if you get a serious illness. It is different from Income Protection as it pays out once.

Your health is determined by diet, exercise, and genes. However often it’s a roll of the dice as to whether someone gets a serious illness such as cancer. Serious Illness cover can provide a financial cushion to help cover medical expenses and to take time off work if needed.

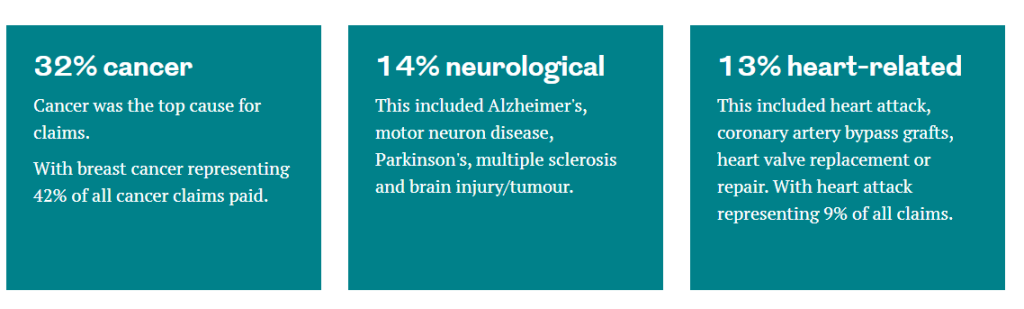

Royal London is one of the leading providers of Serious Illness Cover in Ireland, and they paid 99.5% of their claims in 2021. Top illnesses that were paid out last year:

Royal London – top illnesses paid out in 2021

LIFE COVER

Most people are very aware of Life Insurance. Life insurance will pay out in the event of death. There are subtle differences in the types of Life Insurance available.

Mortgage protection is a decreasing life cover that will pay your bank in the event of your death. Term cover is level life cover that will pay out to your spouse/family. If you’re self-employed you can set up Life Insurance that can be paid through your business, with no benefit in kind, so it’s tax efficient.

I remember talking to a client 5 years ago – he was a little stressed about not having life cover. His friend fell off a boat and had 3 young children. Unfortunately, his friend did not have life cover which left his family in a very difficult financial situation. My client subsequently set up his own Life Cover.

Life Cover is very important for young families.

This post isn’t meant to be doom and gloom. Statistics are on your side – there is a 6% chance of dying before your 60s. However, setting up the right insurance for your circumstances can provide you with financial peace of mind.

People often ask me what type of insurance I have.

In 2015, I set up Life Cover to protect my mortgage. After the birth of my first daughter, I set up Life Cover. After the birth of my second daughter, I set up additional Life Cover and increased the level of Income Protection. I will now be setting up a Serious Illness policy – I turned 40 recently, and at this point in your life, you do start to feel less invincible.

In conclusion, your health is your wealth. With a few financial adjustments, we can all be better prepared to ensure our health is protected so that we, and our families, are in a better position.

When I talk to clients about their protection requirements, it’s a matter of trying to balance the budget with their protection needs. It’s all about finding the right balance. Protecting your health and your family matters.

I wish you all good health.

Eoin Wilson

Financial Adviser

CFP® MSc Finance BA Econ Q.F.A

Please note this is not legal, tax or financial advice.

If you have any queries, please get in touch.