I hope you’re enjoying your summer. In this month’s newsletter, I will be talking about ways to mitigate against the tax man on death, and in relation to gifts.

Thinking about death is not pleasant, but it’s important to consider what might happen when it does happen and the future impact on your estate from a tax point of view. I will discuss a few ways to minimize the tax burden of the next generation.

TAX ON INHERITANCE (CAPITAL ACQUISITION TAX)

Some tax advisers call it a ‘Tax on death’, ‘Tax on Grief’, or ‘Tax on bereavement’. It’s a tax on middle-class savings, rather than the super-rich. No tax is popular. But this one attracts significant venom. Inheritance tax is routinely seen as the least fair by the Western world.

Governments will argue that inheritance tax provides a more equal society. Empirically inheritance and gifts have been found to play a strong role in wealth persistence across generations, particularly between parents and children. I don’t agree with inheritance tax, it’s a double tax on earned income that has already been taxed.

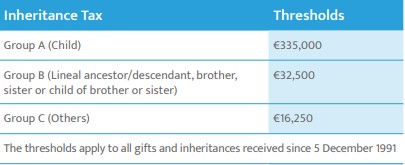

TAX-FREE THRESHOLDS

Parents can give a child a gift or an inheritance of up to €335,000 Tax-free. This threshold is cumulative, so this would include all gifts and inheritances since 1991. Capital Acquisitions Tax is charged at 33% for any inheritances or gifts received above this threshold.

As a Financial Adviser, some clients have asked me for solutions to pass on wealth while they’re still alive to the next generation. One solution is the small gift exemption.

SMALL GIFT EXEMPTION

From the Revenue manual:

“You may receive a gift up to the value of €3,000 from any person in a calendar year without having to pay Capital Acquisitions tax. This means that you may take a gift from several people in the same calendar year and the first €3,000 from each giver is exempt from CAT.”

This small gift exemption applies only to gifts and not to inheritances.

This €3,000 annual tax-free gift allows people to transfer wealth easily and incrementally. Parents and grandparents increasingly do this to help the following generation to get a start in life, for instance, to help fund childcare costs or provide a deposit for a property.

INVESTING THE SAVINGS

One way to grow wealth for the next generation is to set up a child savings account or bare trust. A bare trust is a type of trust that allows money to be paid by a settlor to a trust fund managed by a trustee (often parents and grandparents) on behalf of the beneficiary (often children) of the trust. A bare trust can be used to gift money to children under the age of 18. As an example, if parents paid €3,000 a year into a children’s savings account for 20 years. Using past performance figures of an actual fund with Zurich Life. The Prisma Max fund has yielded 10.9% per annum on average.

EXAMPLE

- Parents pay €3,000 a year into child savings account for 20 years

- Invest in Prisma max fund with Zurich (past performance 10.9% on average for last 5 years)

- Management charge 1.25%

- Future Value €161,170

- Total paid in €60,000

- Growth €101,170

- Tax rate – 41% (€41,471)

- Total after-tax return €119,691

Most families in Ireland wait until they pass away before any assets are passed to their estate, it’s important to note that assets can be transferred at any time, and sometimes it makes more sense to pass the assets before death.

ON DEATH

Passing assets on death can be a complicated process. I would always recommend setting up a will with a good solicitor to ensure your estate is in order.

However, let’s look at an example that will show how you could protect your estate from the tax man.

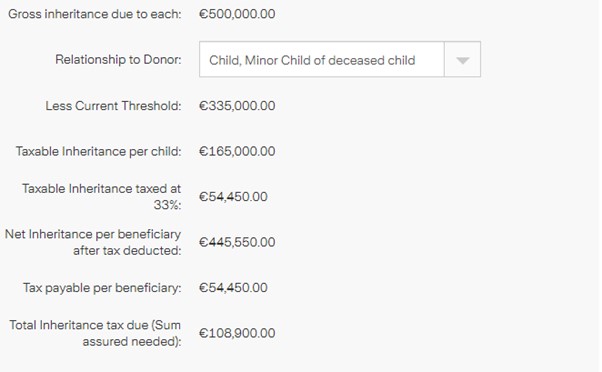

Let’s say Bob and Mary pass away, they have good innings and die at 85 and 90. They have total assets of €1,000,000. 2 properties valued at €500,000 and they have 2 children.

The total tax due for both children is €108,900.

The children may be surprised that Revenue will come in strongly looking for their inheritance tax due. If it’s not paid quickly, penalties and interest will accrue.

Check out Zurich Life inheritance tax calculator Life Inheritance Calculator | Zurich Ireland

ONE WAY TO MITIGATE AGAINST INHERITANCE TAX

There is a way to mitigate against a potential inheritance tax falling due.

SECTION 72 POLICY

Section 72 policy is a revenue-approved whole-of-life insurance policy taken out from which proceeds can be specifically used to pay capital acquisitions tax. A section 72 policy must be taken out and paid for by the person who is leaving the inheritance.

If Bob and Mary took out a Section 72 Policy to insure the potential inheritance tax due of €108,900, their children could inherit the properties with no tax bill.

As an example, for 2 people in their 60s to insure €108,900 this would cost €183.25 per month (with Royal London) To pay for this insurance until the age of 90 would cost €65,970. This is cheaper than the cost of paying the tax bill.

For many clients a Section 72 policy is expensive, and they don’t want to incur extra costs as they reach their 50s and 60s, however, for certain clients, it can alleviate the future inheritance tax burden on the upcoming generation, if that’s their preference

SECTION 73 POLICY

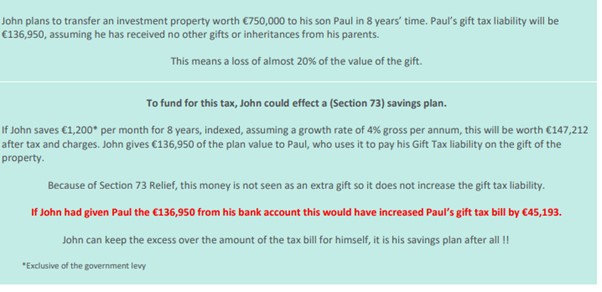

If you are planning to gift assets to your beneficiaries, instead of leaving them as an inheritance, Section 73 Relief from Gift Tax can be a valuable part of your client’s estate planning solution.

EXAMPLE

A section 73 policy can be very attractive, as you can also invest the money before paying the tax liability. In the above case, if you plan on giving more than €750,000 to your son, it makes sense to allocate a percentage to a Section 73 policy, to minimize the tax burden.

DWELLING HOUSE RELIEF

One of the most frequently availed reliefs is the Dwelling house exemption. If the criteria for DHE is met a beneficiary will inherit the relevant property-tax free. There is no limit on the value of the property on which relief may be claimed and so this is potentially a very valuable relief. The qualifying criteria for the DHE are set out below.

- The dwelling must have been the sole or main residence of the disponer. (giver)

- The beneficiary must have been resident in the property for at least 3 years prior to the disponer’s death.

- The beneficiary must not own an interest in any other property including another property inherited from the same estate to qualify for this relief.

- The beneficiary must occupy the property as his sole or main residence for 6 years after the

Enjoy the rest of the summer, hopefully, we get to see more of the sun!