Investing is incredibly difficult when trying to predict the next big stock. In this newsletter I will debunk the myth of concentration risk and explain why buying the whole index is the key to wealth- you will automatically pick the winners.

ONLY A HANDFUL OF STOCKS DROVE STOCK MARKET GROWTH

The S&P 500 delivered over 23% return in 2025. Many of the naysayers love to point out if you exclude Nvidia’s incredible gains 171% of the year, the S&P 500 would be a lot lower.

Please note: Return concentration in Public Markets isn’t a bug, it’s a feature.

Since 1926 just 3.4% of stocks have accounted for all the net wealth created in the US Stock Market. This fascinating nugget of wisdom comes from Professor Hendrik Bessembinder, who has made a career of unearthing truths about wealth.

He has researched the Stock Market between 1996 and 2020 and confirmed the following

- 58.6% of U.S. stocks destroy shareholder wealth

- 41.4% barely surpassed the yields of government bonds

- The real superstars? Just 3.4% of stocks (966 firms) are responsible for the entirety of net wealth creation—$55.11 trillion over nearly a century.

120 companies (just 0.43%) created 60% of this wealth, and 317 companies (1.13%) created 80% of net wealth.

Wouldn’t it be lovely to only invest in those winners? That’s the dream the entire asset management industry has been chasing since the dawn of time. However, the Industry can’t predict where the winners will come from.

|

|

|

THE POWER OF A SELECT FEW

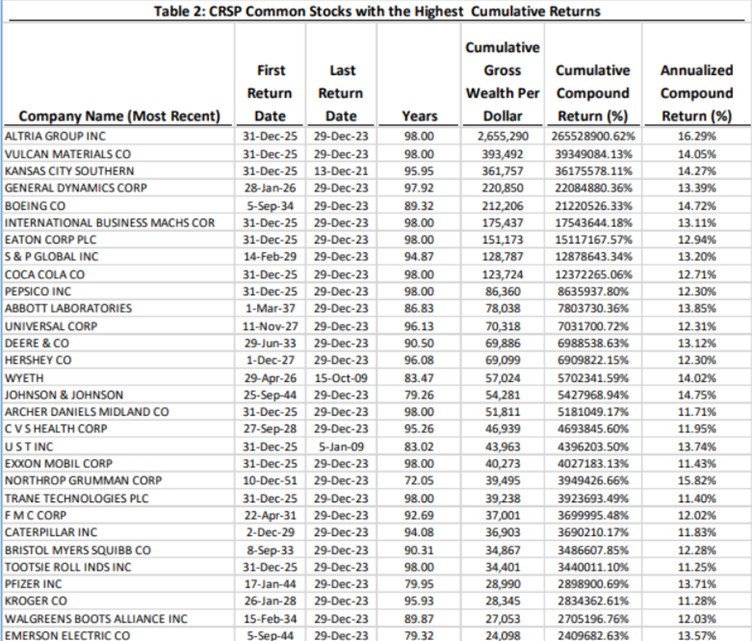

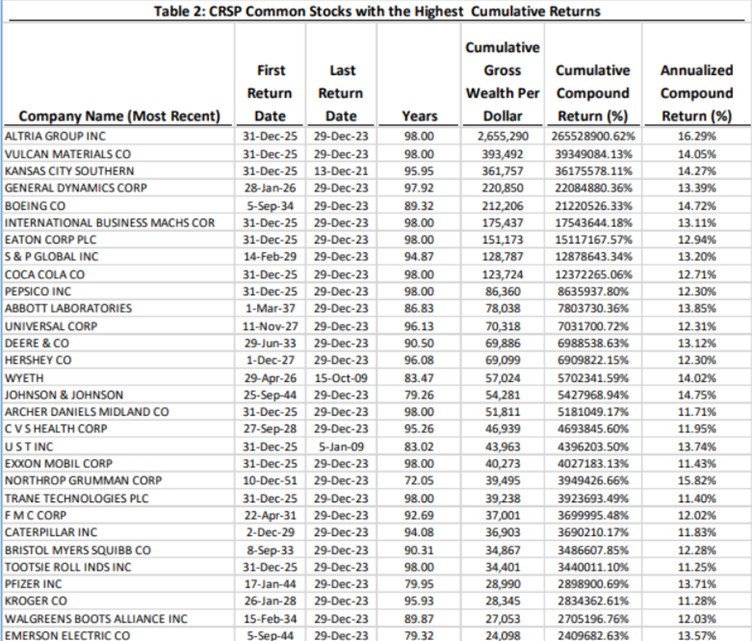

The top performing stocks since the early 1900’s

|

|

In a research paper published in 2024, Bessembinder and his colleague analysed 29,078 common stocks from December 1925 until December 2023.

- Outliers were extraordinary: 17 stocks delivered cumulative returns exceeding 5 million percent (€50,000 for every €1 invested)

- Annualised returns of the top performers were 13.47% over a very long period of time

- Across 29,078, the median cumulative return was -7.41, with 52% of stock delivering negative returns over their lifetimes. Yet the mean cumulative compound return across all stocks is 22,840%

The typical listed public company is a net loss maker over its lifetime. However, when you combine the performance of all companies, the average outcome isn’t just positive, it’s extraordinary when compounded over time.

How is this possible? There a few superstar stocks that generate returns so enormous they make up for the losses of the majority. This is the beauty of buying the whole haystack or the whole index. This is where the magic shines. You don’t need every stock in your portfolio to be a winner. Most of them will probably lose money. The key is to hold the few outliers that deliver astronomical returns. The creator of Vanguard Jack Bogle famously said “Stop looking for the needle in the haystack. Just buy the haystack”

ANXIETY OF INVESTING IN MAGNIFICENT 7

Nvidia alone accounted for 22% of the S&P 500’s return in 2024. The other six members of the Magnificent 7 – Alphabet, Amazon, Apple, Meta, Microsoft and Telsa contributed 33%. This elite group was responsible for 55% of the index’s total return

Do I lose sleep over the Magnificent 7 losing their momentum or market dominance? Not in the slightest.

Let’s look back to 2016. The top wealth creators of all time up to that point (1926 to 2016) were names like Exxon Mobil, Apple, Microsoft, IBM General Electric and Altria. Nvidia wasn’t even in the top 100. Tesla wasn’t in the top 300. As an index investor, Nvidia would have been already sitting quietly in your portfolio bidding its time. You didn’t have to predict its rise. All you had to do was sit tight.

When Nvidia and the rest of the Magnificent seven have had their day and retreat into the sunset. The next set of Super star stocks which are likely already in your portfolio, will take over. The beauty of buying the whole hay-stack is that you’re always holding the next big winners -long before anyone knows their names

The next time someone says to you “you should be worried about concentration risk” please advise them that this is how it is, how it will be now and forever. You want to hold the haystack, which will automatically pick the next Super Star Stocks.