Irish banks have the power now to dictate the rates they wish to charge on mortgages and deposit rates. There is a disconnect between what the ECB is charging and what the Irish banks are charging, however, it will probably be only a matter of time before we hit equilibrium.

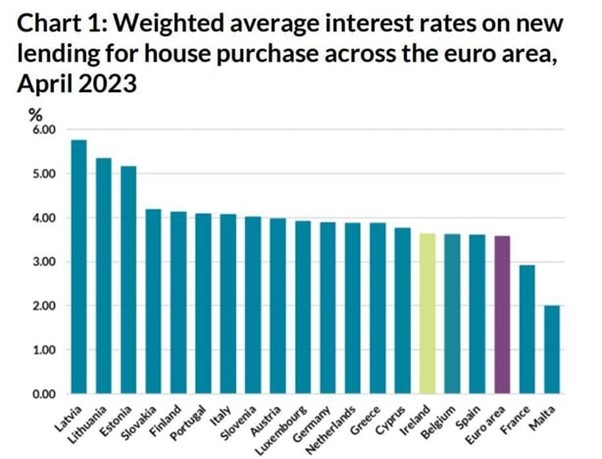

Currently, our mortgage rates are one of the lowest in Europe, and our deposit rates are also low when compared to the rest of Europe.

Irish retail banks have lagged behind their European peers when passing on rate rises on both lending and deposit rates for Irish households. This partly reflects structural factors in the Irish Market (the high concentration of a small number of banks) but also the relative size of the retail deposit base compared to the demand for credit.

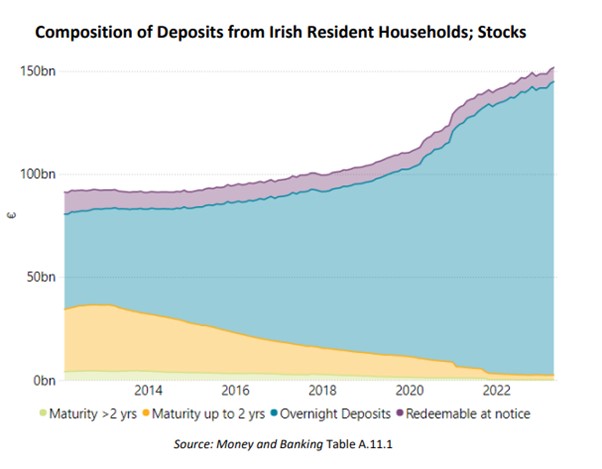

Irish banks have significantly lower loan-to-deposit ratios than the average across the ECB.

In Europe, banks lend nearly 100% of their deposit base, whereas in Ireland the pillar banks lend less, 58% for AIB (loan to deposit), 73% for Bank of Ireland, and 90% for PTSB.

Another significant factor is the level of deposits held in Ireland. Household deposits in Ireland, hit a record high in April 2023, amounting to €152 billion, this represents an increase of €7.9 billion for the year. Most of these deposits are short-term and not locked in.

There is also a significant lack of competition. With the unfortunate exit of Ulster Bank and KBC, there is a lack of competition on both fronts.

BEST DEPOSIT RATES IN IRELAND

With ultra-low deposit rates for years, if you have money on deposit, now is the time to review your deposit and make sure you’re earning interest.

I scanned the market and if you want to deposit €10,000 for 1 year, these are the best deposit rates with Irish Banks

- AIB 1.5% (Annual Equivalent rate)

- PTSB 1.25% (Annual Equivalent rate)

- BOI .75% (Annual Equivalent rate)

SHOPPING AROUND

A very attractive 3-year rate (Barclays Ireland) through Standard Life is providing a return of 9.27% and 17.34% for 5 years. (Minimum amount €100,000) If you require further information here, please let me know. Insurance companies have access to banks worldwide and are starting to provide returns greater than 2% within their cash funds, which is great to see.

MORTGAGE RATES

The mortgage space is an interesting space right now. Variable rates are significantly lower than fixed rates at the moment. However, I do think eventually that Variable Mortgage rates will be closely in sync with the ECB lending rate of 4.0%, although this may not happen if the Irish Banks decide to continue with their strategy of keeping deposit rates low and mortgage rates low.

It does pay to shop around with your mortgage. My advice is always to go for the lowest rate possible. A low fixed rate could be a very wise move.

MORTGAGE RATES (27th June 2023)

Avant 3.60% 3-year fixed (less than 60% loan to value)

BOI Green Mortgage 3.4% (4-year fixed )

BOI 3.7% 4-year fixed (less than 60% loan to value)

AIB variable 3.30% (less than 80% loan to value)

ADVISER 3.0 CONFERENCE

I attended the Adviser 3.0 Conference in London. It was a very informative conference, to learn how to be a better adviser from our UK counterparts. The Managing director of Vanguard Europe was there, talking about the Vanguard offering, and how investment behaviour and asset allocation are key drivers in building wealth. I also really enjoyed Karen Brady from the apprentice. I didn’t realize she bought a football club at 23. I also really enjoyed the mariachi band.

PURE FINANCE NEW HIRE

I’m also delighted to announce that I’ve hired my first employee. Emma Persson started at the beginning of April. Emma will be providing administrative support to the business and will be getting to know you.

She’s had a fantastic start in her role as Financial Services Administrator. Emma has twin boys who keep her busy in her spare time. Her hobbies include Aerial Silks and live music.

Emma can be contacted at emma@purefinance.ie for any Administration related queries.

WE HAVE HAD GREAT WEATHER SO FAR THIS SUMMER. ENJOY IT!